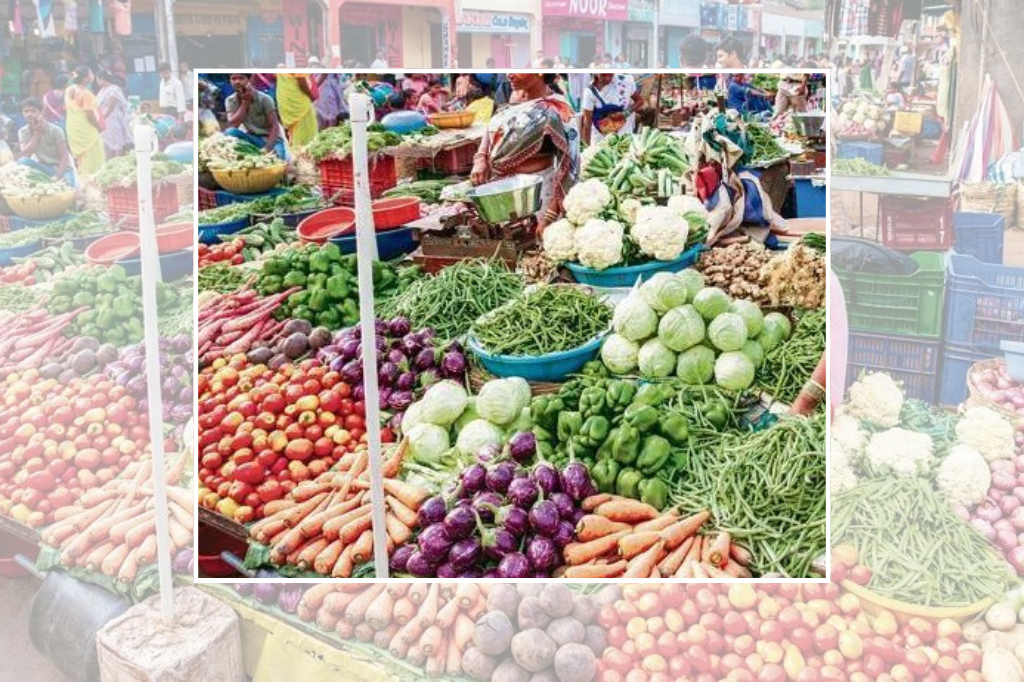

India’s retail inflation dropped to 1.55% in July 2025 — its lowest level since June 2017 — slipping below the Reserve Bank of India’s 2–6% target range for the first time in over six years. The fall was driven largely by a steep decline in food prices, with vegetables tumbling 20.69% and pulses down 13.76% year-on-year.

According to official data, the Consumer Price Index (CPI) has now remained below 4% for six consecutive months. Economists attribute the drop to a combination of favorable base effects, easing core inflation, and robust agricultural output. Ratings agency Crisil projects headline inflation to average 3.5% this fiscal, compared to 4.6% last year, while soft global crude prices are expected to keep non-food inflation under control.

Despite the sharp moderation, bond market trends point towards a prolonged pause in interest rate changes, with the yield gap between 10-year government securities and the repo rate widening — a sign that further rate cuts may be unlikely in the near term.

The government has said the disinflationary trend will help boost household purchasing power, particularly among lower-income groups, and could shape monetary policy decisions in the months ahead.